Introduction

Introduction to Web3.0

To open the doors to the world of web3.0 for everyone, to simplify the task of getting acquainted with and understanding this global change in the Internet for all. To help them avoid mistakes when introducing the new Internet into their lives.

What mistake does practically every beginner make when starting their journey in crypto technology? This mistake is the main enemy of the technology itself. It is KYC authorization on exchanges!How to buy or receive your first tokens and where to store them? On centralized reliable exchanges in the form of Drops, Launchpads, or simply buy the desired currencies? Perhaps. But by starting your journey this way, you leave an indelible mark.

In the world of Blockchain on the internet, there is no need for names, surnames, addresses, and document numbers. Here, the only confirmation of your identity should be your public key, your address in the blockchain.

We do not categorically oppose KYC and centralized services, but everyone should make this choice consciously and not at the very beginning of the path.

Integrating Telegram with Blockchain

To introduce the world of blockchain and cryptocurrency, we suggest combining a product used by over 700 million users (Telegram messenger) with blockchain technology. Integrate into the messenger's base code the ability to:

- Create decentralized chats without being tied to the main account.

- Create stablecoins of any world fiat currency, exchange and send them, and many other cryptocurrencies in a couple of clicks.

- Create your own NFTs to confirm copyright for inventions and/or creative content (audio, video, photo files) and store files in a decentralized cloud storage.

- Create your own dApps based on our blockchain and receive rewards from user usage commissions.

Everyone can join our DAO and actively participate in creating something new in the world of Blockchain on the internet.

Our Mission

To create our project together, we, as the first small group of enthusiasts, decided to study and take the best of existing offerings in the market. To combine the strongest ideas and solutions into one maximally scalable, decentralized, and secure Blockchain.

Observing the development of the blockchain industry, it can be noticed that initially, the main emphasis was placed on decentralization and security, which were perfectly provided by PoW blockchains with the network's proper development. Over time, the development of decentralized product ecosystems required an increase in network scalability. The industry began to move in this direction by replacing the poorly scalable PoW consensus with a much more adaptable PoS consensus and its derivatives. However, PoS consensus noticeably suffers in terms of decentralization.

Thus, different stages of industry development highlight different priorities. In the DES project team, we are convinced that the inevitable upcoming stage of WEB3.0, like the air, requires blockchains that equally address all three problems of the blockchain trilemma, namely:

- Security of network and application operation (the main feature and advantage of WEB3.0 over WEB2.0);

- High decentralization (applications, essentially, should use maximally decentralized solutions);

- Network scalability, allowing to achieve throughput at the level of centralized solutions (for convenience of use and smoothness of interfaces, they must rely on network performance speeds comparable to those of centralized servers).

Most third-generation blockchains declare around 10,000 transactions per second. Some systems claim much higher speeds, but this information is not confirmed upon actual testing (The Solana Network, with a declared speed of 100,000 transactions per second, regularly experiences hang-ups, even with existing (non-peak) loads). To compete, for example, with Visa, it is desirable to achieve a real figure closer to 65,000 transactions per second. Therefore, to prevent the penetration of WEB3.0 from faltering at the very start of its march into the modern world, a multiple increase in the speed of blockchain functioning becomes simply mandatory at this stage of blockchain industry development.

The DES project is created to address the blockchain trilemma by maintaining the security of the existing network (the DES project uses a Cosmos network fork with global changes (consensus, sharding, Proof of Time module)), and by increasing decentralization through improvements and changes to the DPoS consensus and the rules for distributing votes from Active DAO when making decisions on project development (no more than 8% per activist of the project), awarded not for financial contribution, but for an active stance on issues related to the development of the project's decentralized essence, as well as network scaling through the implementation of sharding.

Our Goals

We strive to create a project that allows:

- Newcomers to easily and quickly familiarize themselves with the world of web3.

- Professionals to create quality applications and earn from them (up to 30% of the commissions on their applications).

- Enthusiasts to join the project without any investment using their knowledge and experience, to become part of its asset, even to the extent of joining the project's DAO governing council.

Thus, the goal is to create a fast (up to competitive speeds with current centralized payment systems), secure, decentralized blockchain on an eco-friendly DeDPoS (Decentralized-DPoS) consensus with low fees, making it highly suitable for the development of Web3.0 and dApps.

DES Ecosystem

In addition to this, the DES project is creating its own ecosystem of decentralized products:

- Ecosystem of a centralized messenger (based on the open-source code of Telegram (with enhancements and additions, including all its existing benefits, including user database) with a decentralized section for secure messaging exchange and the creation of a decentralized ecosystem of add-ons to it.

- Ecosystem of decentralized stablecoins with a combined algorithmic support mechanism.

- Ecosystem of a decentralized exchange with spot and futures trading capabilities.

- Ecosystem of decentralized operating systems.

DES Token

Additionally, the project will have its own utility token DES with deflationary tokenomics, which will be used for:

- Algorithmic regulation of the ecosystem support of the project's stablecoin.

- Transaction fees in the blockchain.

- Rewarding project validators.

- Automated payouts to investors, application creators, and project activists.

- Algorithmic filling of insurance and guarantee funds of the project.

- Payouts for airdrops and bounty programs.

Description of the market

Challenges and Solutions

The losses of the global economy from cyber threats have more than tripled over the past 4 years and amounted to an estimated at least $8 trillion in 2022. By 2025, according to expert estimates, global losses could reach $11 trillion, and by 2030 — $90 trillion. This makes it clear that it is unacceptable to strive to increase the scalability of the blockchain by reducing security! In turn, less decentralized projects have greatly discredited themselves by their high centralization and the pursuit of interests primarily of the so-called elites of the project, rather than blockchain communities and libertarian ideals. It turns out to be a kind of "pseudo-centralization". In the eyes of the community, such projects are gaining less and less trust and support for development. Investors are also not eager to develop blockchain projects in which the power of decisive votes is concentrated in the hands of centralized structures (whether they are dominant mining pools of PoW networks, large validators of PoS/DPoS, etc. networks, or the concentration of a large% of project tokens received by the creators or investors of the project in the early stages of project development at very low prices).

At the moment, there are many players on the market providing solutions to 2 of the 3 problems of the blockchain scalability trilemma, and they can be broken down by consensus types:

Projects with PoW Consensus

Advantages:

- High (relatively) decentralization and network security.

Cons:

- Low scalability. As the volume of requests to the network increases, the fees increase. And this disadvantage, without work on leveling it, will not allow PoW networks to become a large–scale participant in WEB3.0 networks, since billions and trillions of transactions will be needed for their operation, and preferably with fees tending to zero. That is, the number of transactions is comparable to the bandwidth of centralized servers.

Projects with PoS/DPoS Consensus and Others Without Proof of Work

Advantages:

- High scalability and fairly high network security.

- High environmental friendliness compared to networks running on the PoW consensus, since miners do not have to participate in the "arms race". They become validators by proving their stake in the project, rather than providing the most computing power with all the consequences.

Cons:

- High centralization, since even with the stated decentralization of the system, most often the maximum voting power is concentrated in the hands of the largest validators with large stakes. The interests of decentralization are far from their first place, and most often the question of decentralization is not at all, and only the initially declared management structure has the right to vote.

At the same time, the problems of centralization of cryptocurrency projects expose them to criticism, investment outflow and a negative information field for the entire cryptocurrency industry.

At the moment, there are no projects on the market that have completely solved the blockchain scalability trilemma.

In the current realities of the development of decentralized solutions, more and more WEB3 applications are gradually appearing. Including messengers.

When analyzing the solutions available on the market, it becomes clear that all modern messengers based on blockchain technology have a problem with speed and smooth operation, as well as the lack of functions and user experience familiar to users of centralized messengers.

The above-mentioned problems of modern decentralized messengers lead to the fact that they lack a user audience. Customers who download blockchain messengers for the first time, without seeing the usual functionality in them and without getting the usual user experience, immediately become disappointed and decide to delete or simply not use such an inconvenient application.

At the moment, the choice of decentralized messengers is quite limited. And they all have significant drawbacks. For example, charges for messages, an insufficiently friendly interface, and slow operation speed.

Also, all of them are united by the lack of any serious user base. At the moment, the most popular such clients are barely crossing the threshold of 100,000 downloads in app stores. This is precisely the result of the fact that, based on a blockchain with existing problems, it is difficult to create dApps that can adequately compete with centralized counterparts, such as Telegram with instant speed, bots, big data and a very friendly and smooth interface, which has already led to more than 900 million users. And first of all, the problem is the speed of operation of decentralized solutions compared to centralized ones.

In existing blockchain networks, with their speed of about 10 thousand. With TPS and substantial fees (for organizing data transfer in messengers), messengers, if they are popular enough, either do not work fast enough or require payment of commissions.

The solution to this problem has pushed a messenger to the masses, which could be both convenient at the level of centralized solutions and would provide people with absolutely safe personal, confidential or intimate communication.

For the base, Telegram was chosen as the usual centralized messenger, as one of the safest, most popular and fastest growing centralized messengers in the world.

The interface of this messenger is quite friendly, intuitive and has a pleasant smoothness and speed.

The functionality is very extensive and allows you to create bots that solve a lot of tasks for both ordinary and business users.

The messenger has functionality that allows you to launch and (manage) targeted business advertising.

Types of Stablecoins in the Modern Market

1. Centralized Stablecoins (USDT, USDC, BUSD)

They are backed by fiat money and the equivalent in stocks, bonds, etc.

Positive:

- The first of the stablecoins on the market.

- Large capitalization.

- Recognition and frequent presence on a large number of exchanges.

Minuses:

- Centralization.

- The ability to block tokens at the smart contract level.

- There are big doubts about the sufficient security of the full issue.

2. Stablecoins Backed by Cryptocurrency (DAI)

It is difficult to find other popular stablecoins of this type on the market.

Positive:

- High decentralization and security (in the case of DAI. Although it is dependent on a centralized USDC, which provides about 32% of the total cost of the DAI issue. It is worth noting that Circle (the USDC Issuer) has allowed the possibility of blocking the collateral contained in the DAI smart contract).

- In the case of DAI, there is increased collateral, which negatively affects the profitability of the application and lower liquidity of the project for the issuer itself.

Minuses:

- By participating in the DAI issue, users must contribute excess collateral to receive the required number of tokens. So, for example, in order to issue DAI in the equivalent of $100, it is necessary to deposit collateral, for example, in an Eth coin in the amount of at least $150, so that positions are not liquidated.

- High commissions of the Ethereum network.

3. Algorithmic Stablecoins (USDD, USDN, UST)

The last two have radically lost their binding to $.

Positive:

- High liquidity of the providing coin and its growth with the growth of the capitalization of the provided stablecoin.

Minuses:

- The possibility of losing the link to the target fiat currency in case of sharp fluctuations in the cryptocurrency market and insufficient elaboration of security algorithms.

At the moment, the market does not lack representatives of the stablecoin ecosystem. There are really a lot of them. I can't even remember everything.

However, as mentioned above, almost all of them have some flaws or even critical vulnerabilities that scammers or competitors sooner or later exploit.

Currently, there are a lot of decentralized exchanges, however, they have only in the last few months begun to approach centralized exchanges in their functionality, without losing the advantages of decentralization.

(There are only a few of them in the Cosmos ecosystem, and they are under development or testing.) Existing exchanges are quite different from each other and have their advantages and disadvantages, we have summarized the weaknesses and strengths of existing DEXs involved in the implementation of the following functionality of centralized exchanges:

Positive:

- Anonymity.

- Lower fees compared to centralized (CEX) exchanges.

- The absence of intermediaries, which are centralized exchanges (CEX): Binance, Exmo and others. This increases the level of security by returning control of assets to the parties involved. Transactions between traders on DEX exchanges are carried out using verification through multi-signatures.

Minuses:

- The absence of many options for traders, such as margin trading or the choice of the order mode for the vast majority of representatives of this type of exchanges. (Exchanges are actively developing in this direction, but products from strong projects are still in the testing process).

- Many DEXs operate on smart contracts, so only tokens with support for smart contracts of the respective networks can be traded on them.

- There is an acute issue with liquidity.

Thus, at the moment, DEX exchanges are solving the problem of decentralization and low fees, however, in terms of convenience, speed and functionality, they are very much losing to their centralized competitors, not being able to solve the lion's share of the tasks that centralized exchanges solve and which have long been very firmly embedded in the lives of crypto investors and enthusiasts. It is precisely such a DEX exchange (simplifying the user experience and bringing it closer in functionality to CEX) that the DES project plans to develop in the future, after attracting investments and achieving initial goals.

The modern world requires more and more mobility. At first, desktop personal computers were popular, then laptops began to gain popularity, then tablets and smartphones. People want to carry all the information with them and have access to it at almost any moment.

Another important point is the need for secure use of information.

The optimal solution to both issues at the same time would be to provide users with the opportunity to access all their resources using the minimum size of the storage medium, running the management of your data and resources from anywhere in the world in a decentralized manner (using DPN) and verification in this system using a decentralized wallet. It is precisely such an operating system that the DAO DES project plans to implement.

Product description and proposed solution method

Third-generation Decentralized Blockchain

The Decentralized EcoSystems project is being created with the aim of solving the blockchain scaling trilemma, which means creating a blockchain network that, without questioning security and decentralization, will ensure scalability and network speed comparable to centralized servers, necessary for the operation of Web3 and dApps networks and their usability at a comparable level with centralized networks and applications.

To solve this problem, the fork of the Cosmos Network project (DPoS consensus) is used as the basis.

Given that there were no problems with the security of the Cosmos network, the possibilities of increasing the decentralization and scalability of this network were explored.

Features of DecentralizeDPoS Consensus:

- An additional Proof-of-Time algorithm is added (based on the time spent in the validator network). Thus, validators are encouraged to be as technically compliant as possible with the requirements of the network.

- The network management module is being upgraded: the highest governing body of the network is the DAO (decentralized autonomous organization), in which the most active participants of the decentralized network have the greatest voting weight, not the holders of the largest pool, but the most active participants in the decentralized network, with a maximum share limit of 8%, which encourages network participants to participate more actively in the functioning and development of the network towards decentralization and socialization.

To increase the scalability of the projected network, a sharding mechanism will be implemented in the source code of the Cosmos blockchain.

Sharding will be implemented as follows:

- The concept of a general validator is introduced. This status is assigned to a node that acts as a validator when approving a block with its group (shard).

- Based on the Proof of Time algorithm, a node fault tolerance rating is introduced. The longer the uptime and the absence of penalties (for work not done or not online), the higher the node's rating.

- The most reliable nodes get the right to become general validators of shards.

- All network validators are randomly pre-grouped into groups of 5-15 nodes every (1-15 is specified during the testnet process) seconds, and by the time the block is validated, they are formed (into shards), and they are in a fail-safe state and ready to quickly and safely verify and approve (or reject) the proposed block.

Thus, due to the announced technical solutions, the DES blockchain will be as close as possible to solving the blockchain scaling trilemma, since it will be able to conduct the number of transactions as close as possible to the fastest centralized systems without compromising the decentralization and security of the network.

Considering these technical scaling solutions, it was decided to make the fees minimal (the transaction fee will range from 0.1% to 0.02% of the transaction amount. A detailed description can be found in the DES token issue section). Due to these factors, it will be easy and profitable to create high-performance WEB3 applications based on the DES blockchain.

To support novice application developers, at the initial stage of the project, the transaction fee will be increased to 0.1% and will decrease as the number of transactions increases to the projected commission amount of 0.02%.

Also, this transaction fee will be related to the total number of transactions in the DES ecosystem. As the number of transactions and capitalization increase, the cost of transactions will decrease.

The difference between the initial commission (0.1%) and the project commission (0.02%) will be distributed as follows:

- Reward app creators (30%)

- Remuneration of validators (20%)

- Operating expenses (25%)

- Filling the liquidity pool of the main coin of the project (DES) (10%)

- Project Development Fund (10%)

- Replenishment of the activist reward pool. (5%)

Also, the project has developed and will launch its own ecosystems of decentralized products.

An ecosystem of a centralized messenger with a decentralized messaging unit with the following additions:

- A decentralized cryptocurrency wallet with the ability to add new networks and tokens (at the addresses of contracts and other necessary data) with the ability to transfer cryptocurrencies directly inside decentralized chats.

- DPN (Decentralized VPN).

- Decentralized storage.

- A decentralized browser with the possibility of verification using a cryptocurrency wallet.

- Video hosting (hybrid: centralized + decentralized).

- Photo hosting (hybrid: centralized + decentralized).

- Audio hosting (hybrid: centralized + decentralized).

- NFT-generation of audio -photo-video and PDF content.

- Synchronous audio transfers.

- Decentralized audio and video calls.

- "Portfolio Analyst" (a module that allows you to monitor the trends of portfolio assets in one place, including graphs (thumbnail on the main page and full on the page) and the cost from the moment of purchase in the portfolio and for periods).

- The button for quick transfer of crypts to stables. It is useful in case of a sharp drop in the alt market. To automate the process across the entire portfolio at once.

- "Startup Analyst" (collects information about projects based on open information on the Internet on startup verification algorithms and assigns a rating to a startup based on this verification). It also collects and analyzes a database of names (to analyze the background of the creators) in the crypto industry.

- To implement the messenger, the source code of the Telegraph messenger will be taken (in part of the centralized messenger section).

The decentralized section of the hybrid messenger DES will be based on solutions in accordance with the roadmap of the project:

- A Telegram bot that redirects data from decentralized chats to Decentralized Storage via decentralized data transfer nodes (DPNs).

- Adamant open source decentralized messenger with DPN-based data exchange and Decentralized Storage DES.

The two sections of the messenger will function completely independently of each other.

An Ecosystem of a Centralized Messenger with a Decentralized Messaging Unit

The ecosystem includes the following additions:

- A decentralized cryptocurrency wallet: With the ability to add new networks and tokens (at the addresses of contracts and other necessary data) with the ability to transfer cryptocurrencies directly inside decentralized chats.

- DPN (Decentralized VPN): Ensures secure and anonymous network connectivity.

- Decentralized storage: For secure data storage.

- A decentralized browser: With the possibility of verification using a cryptocurrency wallet.

- Video hosting (hybrid): A combination of centralized and decentralized technologies for storing and transmitting video.

- Photo hosting (hybrid): Similar to video hosting, but for photos.

- Audio hosting (hybrid): For storing and transmitting audio files.

- NFT-generation of audio, photo, video, and PDF content: The ability to create NFTs from media files.

- Synchronous audio translating: A feature for real-time automatic audio translation.

- Decentralized audio and video calls: Secure calls through a decentralized network.

- "Portfolio Analyst": A module that allows you to monitor the trends of portfolio assets in one place, including graphs (thumbnail on the main page and full on the page) and the cost from the moment of purchase in the portfolio and for periods.

- The button for quick transfer of crypts to stables: Useful in case of a sharp drop in the alt market. To automate the process across the entire portfolio at once.

- "Startup Analyst": Collects information about projects based on open information on the Internet on startup verification algorithms and assigns a rating to a startup based on this verification. It also collects and analyzes a database of names (to analyze the background of the creators) in the crypto industry.

- To implement the messenger, the source code of the Telegraph messenger will be taken (in part of the centralized messenger section).:

The Decentralized Section of the Hybrid Messenger DES

The decentralized section of the hybrid messenger DES will be based on solutions in accordance with the roadmap of the project:

- A Telegram bot: Redirects data from decentralized chats to Decentralized Storage via decentralized data transfer nodes (DPNs).

- Adamant open source decentralized messenger: With DPN-based data exchange and Decentralized Storage DES.

The two sections of the messenger will function completely independently of each other.

Our ecosystem is based on a combined consensus (75% collateral (similar to DAI) + 25% algorithmic support with our own DES coin), with the following characteristic advantages:

- 75% of the collateral: Formed from at least 15 of the most decentralized cryptocurrencies in the world with a large community and multidirectional volatility (for a detailed description, see the decentralized stablecoins section of the project).

- 25% of the collateral: Implemented algorithmically, using the project's own DES coin.

- Stablecoin issuance: 70-75 DESStable stablecoins can be issued for the equivalent of $100.

- User-created stablecoins: In the future, users will be able to create their own stablecoins in their wallet, as well as previously undeveloped fiat currencies or other goods that work in accordance with the general principles of issuance and security embedded in the ecosystem algorithm.

Description:

One of the products of our blockchain project is stablecoins of various currencies of the world. If desired, each user will be able to create their own stable currency in the amount they need.

The minimum security for our stable currencies will be fractional. 125%-150% (depending on the volatility coefficient of each specific security cryptocurrency) of the security value (in the range from 70 to 80%) is confirmed by means blocked by the user, in the form of one of the cryptocurrencies on the list available for blocking.

The list contains about 16 top DeFi cryptocurrencies by market capitalization that have no claims on issues of decentralization and security based on data from CoinMarketCap, CoinGekco and TradingWiev.

Another 25% of the value of the additional collateral will be blocked in DES coins from a special pool by a smart contract. Total: each stable coin will be secured with collateral for at least 150%, depending on the level of volatility of each specific security crypto currency.

It should be understood that the threshold of 150% is the minimum threshold for collateral. And if the value of the asset falls below this threshold, the collateral will be liquidated. Therefore, if the user plans to return the collateral after the targeted use of stable coins, he will need to be safe and deposit collateral in excess in order to avoid liquidation of his collateral.

Collateral Mechanism:

The part of the security that is implemented based on the deposit of an excessive amount of cryptocurrencies will work by analogy with the security mechanism in the DAI project from MakerDAO with the following differences:

- Only coins from the "DES Crypto Asset Decentralization Rating" are accepted for deposit into the security vault at the first stages, which ensures that there is no dependence on security problems in centralized assets such as DAI's USDC.

- The user deposits a collateral asset for only 75% of the target volume of 125-150% (depending on the volatility rating of each security cryptocurrency).

Algorithmic Collateral with DES Tokens:

The part of the collateral that is implemented through DES tokens will be filled from a pre-formed security fund (in the form of a smart contract) in the amount of 200 million DES, which will be constantly replenished in the amount of 10% of the cost of commissions for all actions with the stablecoins of the DES project.

With a drop in the volume of collateral for cryptocurrencies, in the range from 125% to 120%, collateral regulation occurs by replenishing the volume of DES tokens transferred from the project's security pool of stablecoins to the collateral contract. If the value of collateral continues to fall, cost regulation mechanisms based on arbitration and liquidation of collateral are activated (by analogy with the DAI project).

Decentralized Exchange (DEX)

The recent development of DEX shows that the cryptocurrency market is in great need of such products, but each exchange individually does not meet all the needs of the communities. The DAO DES team analyzed all the requests and implemented it in one product:

- Anonymity: Ensures user privacy and security.

- Low commission: Reduces transaction costs for users.

- The absence of intermediaries: Transactions are verified through multi-signatures, eliminating the need for centralized intermediaries.

- Multiple options for traders: Supports margin trading, futures trading, and other advanced trading features.

- Maintaining a familiar and user-friendly interface: Ensures ease of use for both novice and experienced traders.

- Interoperability (IBC module): Expands access for network tokens that support interaction with this protocol, enhancing cross-chain functionality.

Liquidity Management:

In addition, the DAO DES team understands the critical importance of sufficient liquidity for the functioning of the exchange and has developed a pool of tools to maintain its high level. These tools include:

- Algorithmic market-making: Ensures continuous liquidity by automatically adjusting prices based on supply and demand.

- Liquidity pools: Users can contribute to liquidity pools and earn rewards, ensuring a steady flow of assets for trading.

- Incentivized participation: Traders and liquidity providers are incentivized through rewards and reduced fees, encouraging active participation in the ecosystem.

When designing a decentralized OS, the DES project will focus on the following aspects:

- DES OS eliminates the risks of censorship and data leaks: All data is encrypted and distributed over the network (analogous to IPFS + Tor).

- Logging in through a decentralized wallet eliminates hacking through logins/passwords: "Imagine that you are working with documents in DES OS: Files are automatically encrypted and stored in a decentralized repository. Access to the desktop is possible from any device via a DPN tunnel."

- Compatibility with all possible devices: The system will be designed to work seamlessly across smartphones, tablets, PCs, and Smart TVs.

(The section is in the process of writing.)

Tokenomics

Main Features

The DES project token, the DES ticker, is a utility coin of the project, which is used for:

- Algorithmic provision of 25% of the value of the DES project algorithmic stablecoin ecosystem: Ensures the stability and backing of the stablecoin ecosystem.

- Collection of transaction fees in the blockchain: Used to incentivize network participants and maintain the blockchain infrastructure.

- Rewards for project validators: Validators are compensated for securing the network and validating transactions.

- Bounty payments for project promotion activists: Rewards for community members who actively promote and contribute to the project.

- Filling the DES coin's liquidity pool on decentralized exchanges: Ensures liquidity and trading availability of the DES token.

- Validators' remuneration: Additional incentives for validators to maintain network integrity.

- Filling of funds for current and insurance needs of the project: Supports operational and contingency requirements of the ecosystem.

Token Issuance

The issue of the DES token is a limited one-time issue. The issue volume is 1 billion coins, distributed as follows:

- 200 million coins: Issued once and locked on a smart contract for the following needs:

- Filling the liquidity pools of the main coin of the project (DES): 40 million coins.

- Insurance funds of the project: 80 million coins.

- Bounty mailing to opinion leaders: 20 million coins (targeted at individuals unlikely to engage in early coin sales).

- The reward of the creators of the project: 20 million coins (step-by-step vesting based on a smart contract, considering market conditions and minimum desired value).

- 40 million coins: Allocation to be decided through discussion by the active and effective community of the project.

- 200 million coins: Stored in a smart contract to ensure the release of new stablecoins.

- 100 million coins: Distributed in investment rounds to attract early funding and support project development.

- 500 million coins: Distributed among the project's activists as a reward for initiating, developing, and implementing proposals aimed at improving the project, which will be accepted by the entire community.

Token Implementation and Project Economy

The DES token is implemented as a utility token within the DES ecosystem, serving multiple purposes to ensure the stability, growth, and decentralization of the project. The tokenomics are designed to align the interests of all participants, including validators, developers, and community members.

- Algorithmic provision of 25% of the value of the DES project algorithmic stablecoin ecosystem: Ensures the stability and backing of the stablecoin ecosystem.

- Collection of transaction fees in the blockchain: Used to incentivize network participants and maintain the blockchain infrastructure.

- Rewards for project validators: Validators are compensated for securing the network and validating transactions.

- Bounty payments for project promotion activists: Rewards for community members who actively promote and contribute to the project.

- Filling the DES coin's liquidity pool on decentralized exchanges: Ensures liquidity and trading availability of the DES token.

- Validators' remuneration: Additional incentives for validators to maintain network integrity.

- Filling of funds for current and insurance needs of the project: Supports operational and contingency requirements of the ecosystem.

Token Issuance

The issue of the DES token is a limited one-time issue. The issue volume is 1 billion coins, distributed as follows:

- 200 million coins: Issued once and locked on a smart contract for the following needs:

- Filling the liquidity pools of the main coin of the project (DES): 40 million coins.

- Insurance funds of the project: 80 million coins.

- Bounty mailing to opinion leaders: 20 million coins (targeted at individuals unlikely to engage in early coin sales).

- The reward of the creators of the project: 20 million coins (step-by-step vesting based on a smart contract, considering market conditions and minimum desired value).

- 40 million coins: Allocation to be decided through discussion by the active and effective community of the project.

- 200 million coins: Stored in a smart contract to ensure the release of new stablecoins.

- 100 million coins: Distributed in investment rounds to attract early funding and support project development.

- 500 million coins: Distributed among the project's activists as a reward for initiating, developing, and implementing proposals aimed at improving the project, which will be accepted by the entire community.

Earnings for Validators, Delegators, and Community Activists

Validators

The validator has 2 earnings:

- Share of transaction fees: Described in more detail in the "Network Consensus" section.

- Remuneration for block validation: The amount will be clarified during the tokenomics and testnet analysis.

Delegators

The delegate has 1 earnings:

- In accordance with a share of 50% of the earnings from validation for 10,000 blocks (described in more detail in the "Consensus Network" section).

Community Activists

Community activists are rewarded as follows:

- Task Assignment: The TAO (Task Assignment Organization) of the project places the assignment in the appropriate section of the forum.

- Requirements and Bidding: The TAO indicates the requirements for performers, deadlines, and the maximum cost of completing the task at the moment. If there are interested parties, they place bids on how much they are willing to complete the task. If there are no offers, the TAO may decide to increase the cost of completing the task by 10% every 3 days, but not above a specified limit.

- Selection of the Best Solution: If several participants agree to complete the task for the same cost, the solution with the most optimized code is chosen.

- Remuneration: Upon successful implementation of the solution, the contractor receives remuneration in the project's stablecoins. For more information about this process, see the subsection "Mining coins for creating benefits in the project" in the "Project Management" section.

Before launching the project, a pool is being formed to ensure the issuance of DES stablecoins. It amounts to 200,000,000 DES, which is 20% of the total issue. Expenses for the creation and promotion of stablecoins and, according to the decision of the DAO, stablecoins can also be made from this pool.

Distribution of the Remaining 200,000,000 DES (20% of the Issue)

The remaining 200,000,000 DES (20% of the total issue) is distributed as follows:

- 40,000,000 DES (4%): Sent to the DES coin liquidity pool paired with coins from List 2, which can be adjusted by the decision of the community. The purchase of coins into the liquidity pools is implemented through the release of stablecoins backed by DES coins. These stablecoins are exchanged for targeted cryptocurrencies, which are subsequently sent to liquidity pools paired with the DES coin. This ensures the liquidity of the DES coin without spilling it into the market, which could lead to a value dump.

- 40,000,000 DES (4%): Paid to the participants of the DES Arena direction.

- 80,000,000 DES (8%): Allocated to the company's reserve fund. Coins from this fund are sold by the decision of the DAO participants for the needs of the project through the exchange of coins from this fund for the project's stablecoins and, subsequently, their sale on the market.

- 20,000,000 DES (2%): Payment to the founders of the project at the first stage of the issue immediately after the launch of the blockchain, distributed as 1% per month of the total number of coins from one participant.

- 20,000,000 DES (2%): Sent to opinion leaders in the crypto industry (based on community Offers and Solutions) in order to gain support for the project and promote it.

When conducting financial transactions on the DES network, fees will be charged for each such transaction and distributed within the project as follows:

- 30%: Remuneration to the creators of DES ecosystem products from transactions taking place directly on their applications.

- 20%: Reward for validators/delegators.

- 25%: Allocated to the company's operating expenses.

- 10%: Added to the DES liquidity pool.

- 10%: Allocated to the company's Development Fund.

- 5%: Replenishment of the reward pool for project activists.

Increasing Liquidity and Ensuring the Value of the DES Coin

To increase liquidity and ensure the value of the DES coin, 10% of the commissions from the cost of all transactions in the project network will be used to replenish the liquidity pools with the most decentralized coins created at the project launch stage (invested with funds received from investors and the community, which will later receive commissions from exchange transactions in these pools as a reward). The initial list of coins is based on the top 100 from CoinMarketCap and CoinGecko (see Appendix 1 to the Whitepaper).

Mechanism for Replenishing Liquidity Pools

When the liquidity pool is replenished with coins received from transactions, stablecoins secured with DES tokens will be issued. These stablecoins will then be exchanged for tokens paired with DES tokens in the liquidity pools. This mechanism ensures:

- No Risk of Dumping DES Coins: By avoiding excessive spilling of DES coins into the market.

- Increased Transaction Fees: Stimulating growth in the amount of commissions within the project.

Benefits of the Scheme

- Reduction of DES Coin Circulation: Part of the DES coins will be withdrawn from circulation (see the description of the functioning of stablecoins in the Whitepaper).

- Increased Applicability of Stablecoins: Stimulating the growth of stablecoin capitalization and improving the tokenomics of the DES coin.

Participation of Other Project Stakeholders

Other project participants (activists, validators, delegators, investors, and others) will also be able to replenish these pools using the same scheme. This will:

- Increase Their Earnings: By contributing to the liquidity pools and earning rewards from transaction fees.

- Stimulate Growth in Liquidity and Value of DES Tokens: Further enhancing their earnings and the overall health of the ecosystem.

Investment Opportunities for Network Participants

Each network participant has the opportunity to invest their DES coins (or DESStable stablecoins) in one of the products that are under development by DAODES or can be implemented in the DES project (on the project's blockchain). In this case, investments are made only in the project's stablecoins.

Benefits for Investors

- Transaction Fee Share: When staking coins into a product/DAO, the investor will receive a portion of the transaction fee (turnover) of this product.

- Investment Flexibility: The investor can choose to invest in a specific product or in the entire line of the DAO, delegating their funds to the project management for distribution among products as needed, at the discretion of the DAO.

- Management Tokens: When investing in a specific product, the investor receives management tokens of that product, allowing them to participate in voting on initiatives within the DAO. The number of management tokens is distributed based on the investor's contribution relative to the total amount required to start the project. Investments account for 21% of the total issue of management tokens, while developers and activists distribute the remaining 79% based on their contributions to the project.

Step-by-Step Investment Mechanism

A step-by-step investment attraction mechanism has been implemented:

- Initial Stage: Tokens are distributed to investors, with no more than 21% of the total volume of management tokens allocated to investors. Each investor can receive no more than $1,000 worth of tokens in this stage.

- Subsequent Stage: The remaining 79% of management tokens are distributed without limiting the maximum number of tokens per investor.

Future Development

For the future, a pool will be created for each product/DAO:

- Fund Allocation: Part of the raised funds will be deposited into this pool, along with contributions from the general community pool (part of the main DAO, which is divided among all products and branches of the DAO). This serves as a support fund for applications that have not yet been implemented. As the number of products increases, this pool will grow.

- Smart Contract Freezing: During the investment attraction phase, all funds raised are frozen in a special smart contract. If the target fundraising level is reached, the funds are distributed according to the predefined plan. If the target is not met within the specified timeframe, the funds are returned to the investors' wallets.

Important Discussion Points

- Investor Participation in Unlocking DES Tokens: A discussion is ongoing about whether investors should receive an additional annual percentage of their invested funds, with 500 million coins allocated for this purpose.

- Post-Launch Remuneration: After the launch of an application or project, developers, activists, and investors receive remuneration in DES tokens, equivalent to the management tokens of the specific DAO, from the transaction fees of that application.

- Path to Parent DAO Management Tokens: Over time, holding management tokens of a product (regardless of how they were obtained: as a developer, investor, or activist) and meeting certain conditions (such as contributing to other areas of network development) will allow a participant to receive management tokens in the parent DAO DES.

Participant Statistics and DAO Membership

Participant statistics are collected using SBT (Soulbound Tokens via smart contracts). When certain achievements are met, the participant's candidacy is first proposed to the community for consideration. With sufficient positive feedback, it proceeds to a vote among DAO members for acceptance into the governing body. This process ensures that the community plays a key role in shaping the leadership of the DAO.

Reward System for Creators and Investors in the DES Project

The DES project implements a reward system for creators and investors of applications based on the DES blockchain. It is implemented as follows:

Application Registration and DAO Creation

- Application Registration: The creator of the application registers it in the system by creating an application questionnaire. This includes a description, goals, objectives, a preliminary assessment of the required investment volumes, and an NFT-zoned version of the White Paper as proof of authorship.

- Approval by the Expert Group: After the questionnaire is approved by the expert group of the community, the author gains the ability to create a DAO. A wallet for attracting investments is linked to this DAO.

Wallet Groups and Investment Attraction

- "Creator" Group of Wallets: Linked to the DAO wallet to reward activists and creators.

- "Investor" Group of Wallets: Linked to the DAO wallet to reward project investors.

- Investment Attraction: After community support, it becomes possible to attract investments into the linked DAO wallet.

Revenue Distribution

After collecting the target amount in the DAO wallet and launching the application, 30% of the total volume of transactions for the product will be credited to the linked wallet. Payments will be made in accordance with the register of wallets linked as "Creator" and "Investor".

- Creator Wallets: Shares between the wallets of creators and activists are determined by the proportion of management tokens held by participants.

- Investor Wallets: Shares are divided according to the proportion of each investor's contribution to the total investment in the application.

Consulting and Ecosystem Development

If necessary, application creators can involve DES ecosystem development managers for consulting on application development. These managers will receive a percentage of the total volume of product transactions. For more information about DES ecosystem development managers, see the section "Accounting for Activity in the DES Project".

Project management

Modified DPoS Consensus Mechanism

For the most part, consensus will run on the Tendermint BFT engine. However, it will be modified to implement a non-standard, upgraded DPoS (Delegated Proof of Stake) consensus mechanism.

Key Differences from Standard DPoS

- Delegator Pool (P1): In standard DPoS, delegators delegate their tokens directly to a chosen validator. In our modified DPoS, delegators delegate their funds to a general Pool of Delegators (P1). The total amount in this pool is considered as 100% for the block of delegators.

- Validator Pool (P2): Validators form their own pool (P2), which determines their voting power. Validators are selected based on their contributions and performance within the network.

- Voting Power Limitation: The project enforces a condition at both the blockchain and DAO levels that no participant can hold more than 8% of the total voting power.

DAO-Based Project Management

All project management is based on the principles of a DAO (Decentralized Autonomous Organization). The DAO is managed by active project participants who contribute to the project through various actions, such as:

- Programming and development

- Participating in hackathons

- Copywriting and content creation

- Translations and localization

- Public relations (PR) and marketing

- Proposing ideas for project improvements

These participants are rewarded based on their contributions, ensuring that the project benefits from a diverse range of skills and expertise.

Encouragement of Validators and Delegators

Validators and delegators are incentivized to ensure business continuity and liquidity through a modified DPoS consensus mechanism. The system is designed to reward both validators and delegators based on their contributions to the network.

Validator and Delegator Pools

- Delegator Pool (P1): Delegators contribute their tokens to a general pool (P1). The voting power of this pool is distributed among validators based on their Uptime (the number of blocks signed consecutively without omissions, fines, or malicious actions) over a period of 10,000 blocks. Validators are ranked, and their voting power is updated periodically based on their performance.

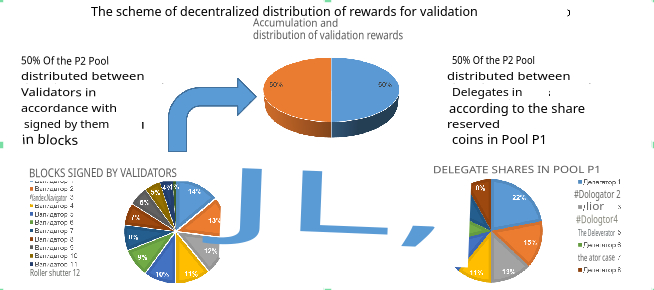

- Validator Pool (P2): Transaction fees collected during the 10,000-block period are placed in a separate pool (P2). This pool is split 50/50 between validators and delegators.

Earnings Distribution

- Validators: Validators earn rewards based on the number of blocks they sign. For every signed block, validators receive 0.01% of the total rewards pool (P2).

- Delegators: Delegators receive 50% of the rewards pool (P2), distributed proportionally based on their share of the total delegator pool (P1). The system adjusts in real-time to account for changes in the delegator pool during the 10,000-block period.

The distribution scheme of remuneration can be represented as follows:

Conditions for Obtaining Validator Status

To become a validator, a participant must:

- Deposit the blockchain's main coin and a stablecoin available on the platform. The stablecoin deposit must be at least 50% of the value of the blockchain coin deposit.

- Maintain the token/stablecoin balance as the value of the blockchain coin increases.

The maximum number of validators at the project's start is tied to network activity, beginning with 4 validators. During the testnet phase, participants can earn test coins for active participation and completing tasks. These test coins will be proportionally converted to real DES tokens upon the mainnet launch. Active validators may also benefit from a reduced initial stake requirement (30% of the minimum stake, with the project covering the remainder).

Validator Collateral and Penalties

- If a validator loses their position, their collateral is unlocked over 60 days. Stablecoins are unlocked in two stages (50% after 15 days and 50% after 30 days), while blockchain coins are unlocked in three stages (1/3 every 10 days).

- Validators attempting to compromise the network or engage in malicious activities will face fines deducted from their collateral. Repeated offenses may result in the loss of all collateral and permanent exclusion from the validator set.

Voting Power and Voice Tokens

- A validator's voting power depends on the amount of collateral they have locked and the funds delegated to them by users (via P1). Additionally, 75% of their voting power is determined by the number of illiquid voting tokens they hold, which are distributed proportionally based on their voting activity and Uptime.

- These tokens are non-transferable and cannot be speculated upon. Validators who leave the project after a period of active participation may receive a share of the voice token pool as a severance package.

DAO Governance

Only the DAO can submit proposals for voting after an internal preliminary vote. Validators are not required to be DAO members, but their voting activity and Uptime significantly influence their voting power and rewards.

Task Exchange: Mining DES Coins for Project Benefits

To implement the process of mining DES coins for bringing benefits to the project, a section of the site called "Task Exchange" is being created. All actions in this section are summarized and transferred to the blockchain for subsequent accrual of activity points.

Task Exchange Overview

- The Task Exchange serves as a forum for making suggestions and includes tools for voting on community proposals.

- Community proposals supported by likes from at least 10% of the voting power of the project's activists are transferred to the Task Exchange rating. Tasks are prioritized based on community voting, with higher-priority tasks receiving funding sooner.

Task Assignment and Payment

- Experts assign the maximum payment amount and requirements for the contractor's competencies and experience for each task.

- If multiple applicants meet the requirements, the task is assigned to the applicant who agrees to complete it for the lowest cost.

- If no applicants are found, the task's price increases by 10% every 72 hours until a performer is found or the task is removed from the exchange.

Funding and Rewards

- Every 10,000 blocks, a fixed number of DES coins are issued. These coins are exchanged for stablecoins and sent to a pool for rewarding task performers.

- Only tasks at the top of the priority rating with sufficient funds can be offered for execution. Performers receive stablecoins equivalent to the agreed payment amount upon successful completion of the task.

- In addition to the payment, performers receive a matching bonus based on their role (e.g., programmer, marketer, polyglot, copywriter, blogger, visualizer).

Path to Governance

Active participants who consistently contribute to the project through the Task Exchange can become full members of the project's governing council, gaining a voice in decision-making processes.

Accounting for Activity in the DES Project

The DES project is managed by Active Members of the Community (referred to as the Asset), who prioritize the social, functional, and decentralized aspects of the network over its economic component.

Key Principles of Activity Accounting

- At the first stage of the project, a system is introduced (see Table 1) to identify and involve the most active community members in project management based on their contributions to the project's development.

- Participants' contributions are assessed using Table 1. The more utility points a participant earns, the higher their status and the greater their share of management tokens during the initial issuance.

- During the development and modernization phase, adjustments to the consensus-building process are allowed, subject to approval by the Community Asset through voting using utility points from Table 1.

- After launch, consensus is achieved using management tokens, which allow participation in voting on proposals but have no economic value.

- Changes to the consensus after the launch of the smart contract/blockchain require tokenized voting by the project Asset.

- When considering proposals, the security and decentralization of the project must take precedence over economic considerations.

Management Token Distribution

-

Initial Issuance:

Management tokens are distributed based on:

- The level of involvement in the project (quality and quantity of actions contributing to the project's development, as per Table 1).

- The participant's reputation (their participation in network management should not raise doubts among other participants).

- Community Pool: A percentage (to be determined by voting) of all transactions in the Liquidity Pool is transferred to the Community Pool, which funds network modernization (e.g., payments to developers, marketing, and motivation of active community members). Allocation of funds from the Community Pool requires tokenized voting by the Asset.

- Pension Fund: The capitalization of the Pension Fund is equivalent to 100% of the management tokens. Participants can return their management tokens to the Pension Fund at any time and receive a proportional share of the funds. If a participant leaves the activist pool, they receive DES tokens equivalent to their share of management tokens from the Pension Fund.

Management Token Revocation

- An Asset member can initiate a vote to revoke management tokens from another member. If the vote passes, the tokens are returned to the Pension Fund, and the owner receives compensation proportional to the number of votes against the revocation.

- Delegators and Validators can also initiate the revocation of management tokens without providing compensation.

Economic Motivators and Inactivity

- Each participant has an economic incentive to contribute to the network, as they can withdraw their share of the Pension Fund and retire from network management at any time.

- Participants who are inactive (failing to meet DAO activity criteria) lose the opportunity to receive management tokens after 5 consecutive instances. Continued inactivity results in exclusion from the Asset and transfer to a monitoring channel.

Weekly Activity Analysis

Based on Table 1, a weekly activity analysis is conducted to redistribute utility points and management tokens from inactive participants back to active mining.

DES Arena: Encouraging Activity in the DES Ecosystem

The DES Arena module is designed to encourage active participation in the DES project ecosystem. Participants can compete in various disciplines to win DES coins, DESS stablecoins, or rewards from project partners.

Overview of the DES Arena

- Participants can compete in disciplines such as logo design, website design, code development, and more. Any activity with more than 10 participants can become a competition.

- A DAO (DES-Arena) is created, overseen by an "Olympic Council" (founders and holders of DAO tokens).

How It Works

- Community members can join an existing discipline by filling out a form with their network nickname, chosen discipline, and initial work submission.

- Members can propose new disciplines by submitting a detailed description of the discipline's usefulness to the community, along with text and presentation materials.

- New disciplines require at least 10 votes of support from community activists to proceed to the participant search phase.

- The winner is chosen by the community. Each network participant can vote once per reporting period (weekly or monthly). Voting participation increases the participant's activity rating (based on SBT).

- Winners are awarded 1st, 2nd, and 3rd place rewards each reporting period. Participants who consistently rank in the top 3 for five reporting periods gain the opportunity to join the Olympic Council with minimal voting power.

Discipline Management

- If no new participants join a discipline after three rounds (five periods each), the Council may vote to close the discipline. A smart contract flags suspicious conditions for Council review.

- The Council can nominate participants for exclusion if they are found to bypass smart contract rules through prior arrangements. Proofs are submitted to the community's expert court for review.

Funding for Rewards

Funds for participant rewards are sourced from a percentage of the transaction fees in the project, specifically allocated to encourage activists.